Rochester, MN

Acquired: November 2020 for $7.45M

Partnership Type: JV

Summary: Stone Haven Townhomes, acquired in November 2020, stands as a testament to our real estate development vision. With the successful completion of Phase I and Phase II, and Phase III in progress, these luxury townhomes command top-tier rental rates. Their exceptional leasing performance underscores the premium quality and desirability of the property, all realized within a remarkable 22-month payback period.

Payback Period: 22 months

Rochester, MN

Acquired: April 2023 for $27M

Partnership Type: Black Swan Real Estate Fund I & Black Swan Real Estate Fund II

Summary: Owned by Fund I & Fund II, this asset is one of the best deals we’ve ever done that will benefit the most investors. 129 unit, Class A urban core asset built in 2019. The first floor has commercial space that has been vacant since it was constructed. We’re renovating that space to build out 25 residential lofts, along with an ultra luxe amenity space.

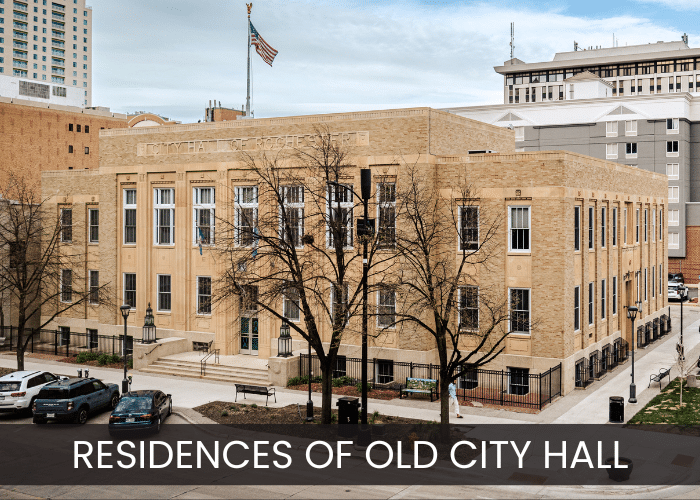

Rochester, MN

Acquired: September 2022 for $5M

Partnership Type: Black Swan Real Estate Fund II

Summary: Boasting an excellent location in the heart of downtown Rochester, this historic gem was acquired under Black Swan Real Estate Fund II, we’ve preserved its legacy charm (and increased its value) with light, tasteful renovations. Another fantastic heritage property revitalized.

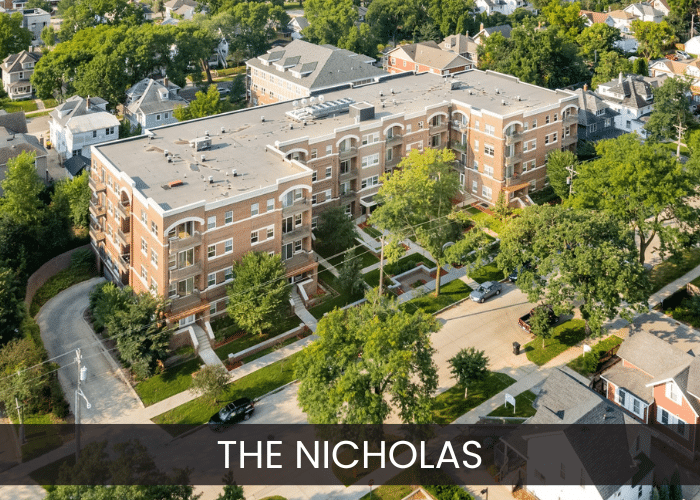

Rochester, MN

Acquired: December 2021 for

Partnership Type: Black Swan Real Estate Fund I

Summary: The cornerstone of Black Swan Real Estate Fund I, The Nicholas boasts 95 class-A units. Built in 2015 and situated in an unbeatable downtown Rochester location, we’ve enhanced the Nicholas’s value with management upgrades and tasteful renovations. Our vertically-integrated team was able to address vacancies with lightning speed, ensuring it remains a highly sought-after property for years to come.

Rochester, MN

Acquired: December 2021 for $2M

Partnership Type: JV

Summary: This beautiful 26 unit building was built in the 1920s, and we’re doing extensive unit renovations while maintaining the historic charm of the building itself. We are still in the midst of renovations at this property, and we’ve seen steady rent growth.

Rochester, MN

Acquired: October 2022 for $5M

Partnership Type: Black Swan Real Estate Fund II

Summary: We’ve seen massive renovation velocity at the Riverview. We’re doing light unit renovations with fresh paint, new appliances, and LVP. We have an HOA supermajority and have done drastic landscape improvements including tree removal, new mulch, and the addition of a dog park. We’ve added a brand new fitness facility in an unused office space. This asset has extraordinarily strong leasing performance.

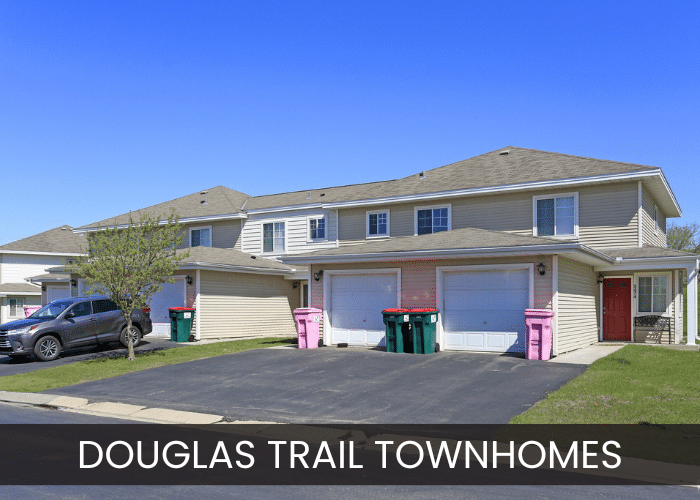

Rochester, MN

Acquired: October 2022 for $11M

Partnership Type: Black Swan Real Estate Fund II

Summary: Acquired in October 2022, Douglas Trail Townhomes boasts 100 units under Section 42 housing. Within 10 months, we’ve achieved significant renovation progress, revitalizing half the property. Alongside management enhancements and tenant turnovers, our landscaping efforts have notably uplifted the community’s feel, making it a standout asset in Black Swan Real Estate Fund II.

Tacoma, WA

Acquired: August 2021 for $9.8M

Partnership Type: JV

Summary: Garden Court West has been reborn through a comprehensive remodel. Strategic enhancements span from individual units to common areas and even the landscaping. We were able to quickly rejuvenate properties and maximize their potential through strategic management improvements.

Rochester, MN

Acquired: October 2021 for $2.6M

Partnership Type: JV

Summary: With 32 premium units under our belt, we’ve successfully achieved a 50% cash-out refinance in just under 20 months, even amidst unpredictable interest rate hikes. A testament to Black Swan Real Estate’s financial acumen and resilience.

Payback Period: 67% return of capital within 20 months

Rochester, MN

Partnership Type: JV

Summary: A century-old architectural marvel, The Furlow has been meticulously transformed through extensive renovations. Located in the vibrant heart of downtown Rochester, this project spoke to our deep passion for revitalizing and adding value to historic properties.

Rochester, MN

Acquired: October 2021 for $3.7M

Partnership Type: JV

Summary: A modern gem built in 2014, The Lofts is strategically located in the heart of downtown Rochester. This asset not only promises consistent returns but as a shining example of our commitment to due diligence and prime deal selection.

Rochester, MN

Acquired: August 2021 for $12.75M

Partnership Type: JV

Summary: Nue 52, a collection of 83 Class B units built in 2015 is a testament to strategic management and renovation. Acquired in August 2021, we swiftly addressed vacancies, enhanced units, improved common areas, and even introduced a dog park. Multiple successful cash-out refinances highlight its growing value, making Nue 52 one of our proudest achievements, all with a swift payback period of 17 months.

Payback Period: 17 months

Rochester, MN

Partnership Type: JV

Summary: Acquired in 2021, The Hamilton boasts 24 units from a 2010 build, this asset was in impeccable condition upon purchase. A truly hassle-free property, it requires minimal maintenance and no renovations. Our strategy revolves around maintaining its pristine status, optimizing rental rates, and enhancing leasing operations to ensure consistent returns.

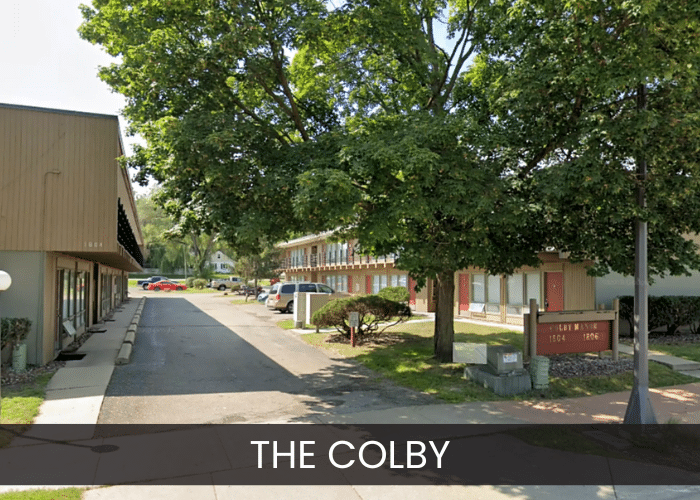

Rochester, MN

Acquired: April 2023 for $2.65M

Partnership Type: Black Swan Real Estate Fund II

Summary: Acquired in April 2023, The Colby presents a unique opportunity with its 32 units. While it’s a Class D building, its prime Class A location and invaluable zoning make it a future redevelopment goldmine. Currently undergoing light renovations, the rental rates achieved have surpassed our projections. Our strategy is to capitalize on its potential with a cash-out refinance at the earliest.

Rochester, MN

Acquired: December 2021 for $1.4M

Partnership Type: JV

Summary: The Zick, a captivating century-old building in a prime downtown Rochester location, was acquired in December 2021. Comprising 19 units, this historic building has been meticulously renovated, with work completed by Q2 2023. As we actively pursue a cash-out refinance, we take pride in the consistent year-over-year rent growth observed in the renovated units, speaking to the property’s enduring appeal and our commitment to value enhancement.

Rochester, MN

Acquired: November 2021 for $2.93M

Partnership Type: JV

Summary: Acquired in November 2021, Uptown Landing boasts 24 units in a prime A+ location. After subtle renovations, the property has seen consistent rent growth and impressive leasing results. With its strong performance, we’re eyeing a strategic cash-out refinance in the upcoming 6-9 months, further solidifying its value proposition.

Rochester, MN

Acquired: November 2021 for $2.3M

Partnership Type: JV

Summary: Uptown Terrace, secured in November 2021, is a collection of 20 units set in a coveted A+ Rochester locale. Post light renovations, the property has consistently delivered on rent growth and robust leasing. Given its stellar track record, we’re gearing up for a cash-out refinance in the next 6-9 months, underscoring its investment appeal.

Tacoma, WA

Acquired: December 2022 for $5M

Partnership Type: Black Swan Real Estate Fund II

Summary: This deal is a mix of residential units, commercial units, and land. This is a more challenging transition, but we’ve successfully turned over problematic commercial tenants. We are actively leasing commercial spaces and making progress on light renovations. We’ve made improvements to the common areas and exteriors.

Tacoma, WA

Acquired: May 2023 for $8.05M

Partnership Type: Black Swan Real Estate Fund II

Summary: Acquired in May 2023, Kensington & Lauriston Apartments comprise two Class C buildings with a total of 63 units, strategically located in a prime Tacoma neighborhood. Even without major construction initiatives since its Q2 2023 acquisition, our emphasis remains on maximizing rental rates, leveraging the property’s inherent desirability to ensure consistent growth under Black Swan Real Estate Fund II

Tacoma, WA

Acquired: September 2022 for $24.15M

Partnership Type: Black Swan Real Estate Fund II

Summary: 130 units, this asset is the cornerstone of Fund II. We are deep into renovations on this project. We’re doing light renovations to the units, and extensive exterior renovations. The massive landscaping project is underway, and we’ve completed exterior painting and added a controlled entry system. Leasing performance is strong and the rents after a light rehab have blown away our pro forma.

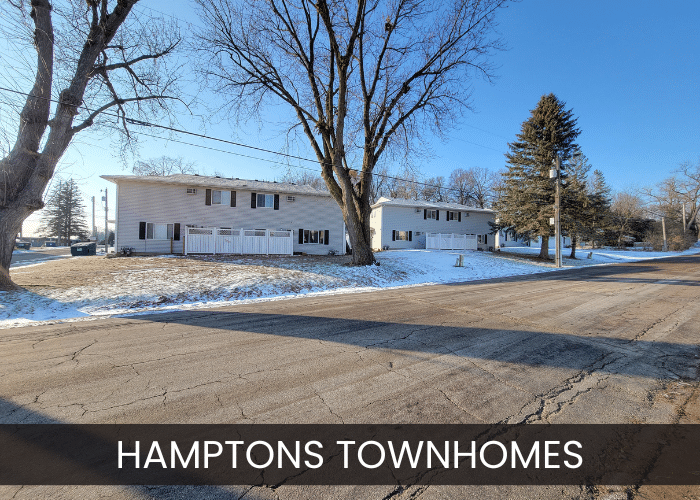

Rochester, MN

Acquired: September 2022 for $1.6M

Partnership Type: Black Swan Real Estate Fund II

Summary: Black Swan Real Estate Fund II had a transformative impact on the Hamptons Townhomes – not only elevating the aesthetics with light renovations, but rejuvenating the surrounding community in the process. Completed just 11 months post-purchase, this project stands as a testament to Black Swan’s efficiency and dedication to community enhancement.