What Makes Black Swan Different

Investor First Model

We believe in a radical alignment of incentives that puts the investor first. How do we do this? We collect no fees whatsoever. No acquisition, asset management, loan recourse, capital event, or disposition fees. We believe in putting the needs of the investor first.

Infinite Rate of Return

For our Legacy Funds (Fund I, II, III, IV), when all invested capital is returned, investors stay in the deal indefinitely. We long-term hold assets to benefit from cash flow, debt paydown, appreciation, and tax advantage. Despite having $0 left in the deal, investors get returns for years and years to come.

Vertical Integration

Black Swan is vertically integrated with our property management company, Black Swan Living. That means we own and manage everything from acquisition all the way down to replacing a lightbulb. Our goal is to make our buildings as profitable as possible by eliminating excess costs in all aspects of asset and property management.

How the Secure Freedom Fund Works

Different from the Legacy Fund model, Black Swan Real Estate Secure Freedom Fund is a fixed return investment for security & cashflow. This investment opportunity is designed to serve all investors—whether you want to benefit from cashflow through fixed monthly payments or steadily grow your wealth by compounding monthly.

MONTHLY PAYMENTS | based on $100k investment

You receive a 10% fixed return of $10,000, paid monthly, in payments of $834 per month.

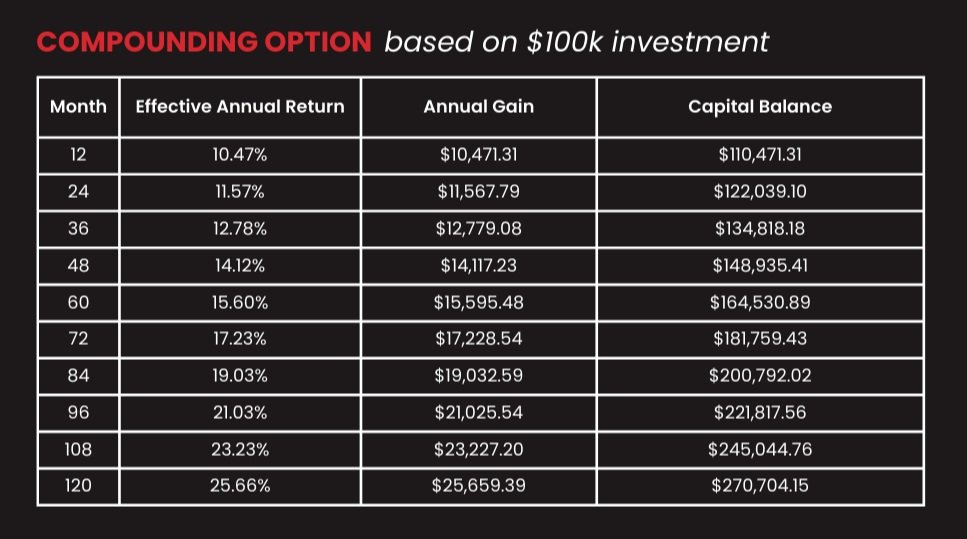

COMPOUNDING OPTION | based on $100k investment

Set it & forget it! Steadily grow your wealth by compounding monthly.

Black Swan Real Estate Secure Freedom Fund is a Reg D 506(c) opportunity available to accredited investors only. The minimum investment is $25,000.

How the Legacy Fund Works

YEARS 1-3

- You invest in the fund and your capital is used to purchase residential real estate

- Properties undergo renovation & management improvements

- You receive cashflow distributions as properties stabilize, typically starting early in Year 2

YEARS 3-4

- Cash-out refi occurs on stabilized properties

- You receive a full return of capital and stay in the deal indefinitely, despite having $0 in the deal!

- Infinite returns start

YEARS 5+

- You receive cashflow distributions each quarter

- Every 3-5 years, we execute another cash out refi and you receive equity distributions (up to 10x larger than a typical quarterly distribution!)

- All assets are sold decades in the future and you receive proceeds from sale in the deal!

You invest in the Fund.

Invested capital is used to purchase residential real estate

Value-add plan is implemented.

Assets undergo renovation and management improvements.

Cash flow distributions begin.

Cash-out refi occurs.

Equity is unlocked for stabilized assets. You receive an equity distribution (target 3-5 years).

You get a 100% return of capital.

You now have $0 left in the deal, but you stay in the deal. Infinite rate of return period begins.

You stay in the deal indefinitely.

Enjoy cash flow and equity distributions, debt paydown, and tax advantages for decades. Assets are sold in 20+ years.

Blue Ocean Strategy

As per the Blue Ocean Strategy by W. Chan Kim and Renée Mauborgne, “The only way to beat the competition is to stop trying to beat the competition.” This philosophy perfectly applies to passive real estate investing. We favor investing in blue ocean markets that are yet to be fully explored and exploit the opportunities that come with it.

Rochester, MN, and Tacoma, WA, are two blue ocean markets that offer investors attractive opportunities for passive real estate investing.

Both cities have growing economies, low unemployment rates, and are home to several renowned institutions and companies. Rochester is the birthplace of the renowned Mayo Clinic, which attracts thousands of patients every year and is the city’s largest employer. Similarly, Tacoma has a thriving economy driven by sectors like healthcare, education, and military.